April 2024

What Affects Your Credit Score In April 2024?

Your credit score is a number that represents your creditworthiness. It is used by lenders to decide whether to give you credit and, if so, how much.

There are a variety of variables that can influence your credit score, which ultimately makes up your credit report.

Some of them, such as making sure you pay any loans on time, are within your power, while others, such as whether or not you have been declared bankrupt in the past, are out of your control.

Topics that you will find covered on this page

What is a good credit score?

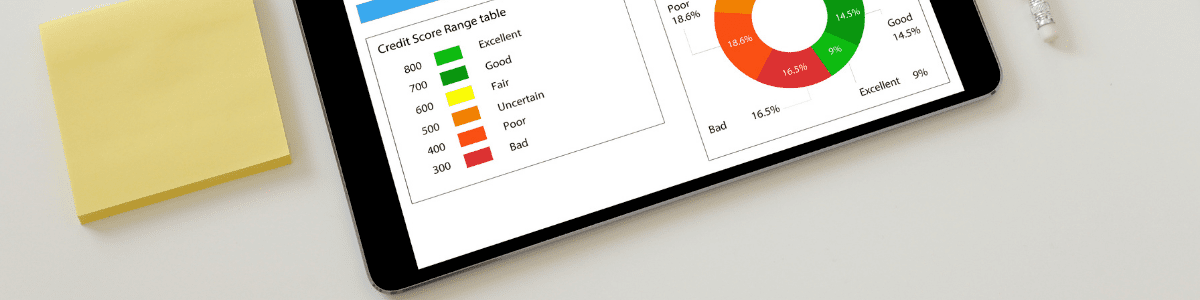

In the UK, there is no such thing as a ‘perfect’ credit score. However, if you have a score of 700 or above on your credit report, this is generally considered to be good. A score of 750 or above is usually considered to be excellent.

Your credit score can go up or down depending on your credit activity. So, if you have been managing your credit well, you should see your score improve over time. Similarly, if you have been missing payments or using too much of your available credit, you should see your score drop.

There are a number of things that can impact your credit score in the UK.

What Affects Your Credit Scores?

The main factors that affect your credit score, and appear in your credit report are:

Payment history

This includes whether you have made all of your payments on time and in full. Late or missed payments will damage your score.

Credit utilisation

The ratio between your credit card debt and the amount of credit you have available to you is shown here. It’s usually smart to keep your utilisation below 30% in order to keep a high rating.

Credit mix

This refers to the many types of credit you have, such as credit cards, shop cards, personal loans, and home mortgages. Having a diverse range of credit can help your score.

Length of credit history

A longer history will usually result in a better score, as it shows lenders that you are a responsible borrower.

Recent applications for credit

Every time you apply for credit, it leaves a ‘ footprint’ on your file. Too many footprints in a short space of time can be viewed negatively by lenders.

Credit history

This is the length of time you have had credit, and is generally seen as a positive factor by lenders.

Applications for new credit

Each time you apply for new credit, it leaves a footprint on your file. Too many footprints in a short space of time can be viewed negatively by lenders.

Bankruptcy

If you have been declared bankrupt, it will have a negative impact on your score.

Would you like more information about your personal credit rating?

Checkmyfile can show you, in one report, data from the leading 3 agencies in the UK

Read some recent 5 star client testimonials, on Trustpilot, about Checkmyfile’s comprehensive credit report

Try free for 30 days and get the information that you need, then £14.99 per month. However, you can cancel online at any time. If you sign up, we will receive a small payment for introducing you. This helps us produce more content for the site.

County Court Judgments (CCJs)

These are orders issued by a court against someone who has not paid back the money they owe. A CCJ will harm your credit score.

Individual Voluntary Arrangements (IVAs)

These are agreements between someone who owes money and their creditors to repay what they owe over a set period of time. Having an individual voluntary arrangement (IVA) will also damage your credit score.

Electoral Roll

Lenders look to verify your identity by checking if you are on the electoral roll at your current address. It is also considered a sign of stability, which may help to raise your credit score.

"Your credit score is a number that represents your creditworthiness. It is used by lenders to decide whether to give you credit and, if so, how much."

Help & Advice Tweet

What doesn’t affect your credit score?

There are a number of things that are not factored into your credit score, such as:

Your salary

Your credit score is not affected by how much you earn.

Your age

Age is not a factor in determining your credit score.

Where you live

Your postcode is not a factor in determining your credit score.

Whether you are employed

Your employment status is not a factor in determining your credit score.

These are just some of the things that can affect your credit score.

What Can Hurt Your Credit Scores?

There are a number of things that can damage your credit score, such as:

Missing payments

If you miss a payment, it will be recorded on your file and will damage your credit score.

Making late payments

If you make a payment after the due date, it will be recorded on your file and could damage your credit score.

Defaulting on a loan or credit card

If you default on a loan or credit card, it will be recorded on your file and could damage your credit score.

Having a County Court Judgement (CCJ) against you

If you have a CCJ against you, it will be recorded on your file and could damage your credit score.

Filing for bankruptcy

If you declare bankruptcy, it will be recorded on your file and could damage your credit score.

Your history of credit use

Your history of credit use affects your credit score because it gives lenders insights into how you manage your finances. If you have a history of late or missed payments, it will damage your score. Similarly, if you have a history of using a lot of credit compared to the amount you have available, it will also damage your score.

How long you have had credit

The length of your credit history is important because it shows lenders how responsible you are for borrowing money. If you have a long history of making timely payments and managing your credit wisely, it will boost your score. On the other hand, if you have a short credit history, or if you have made late or missed payments in the past, it will damage your score.

Your recent credit activity

Every time you apply for new credit, it leaves a footprint on your file. Too many footprints in a short space of time can be viewed negatively by lenders. Making direct debit payments on time is helpful

Your credit mix

Your credit mix is the variety of types of credit you have. Having a mix of different types of credit, such as a mortgage, a car loan, and a few credit cards, shows lenders that you are able to handle different types of borrowing. This can boost your score. On the other hand, having only one type of credit, such as several credit cards, can damage your score.

These are just some of the things that can affect your credit score. Remember, your goal should be to build and maintain a good credit score so you can access the best borrowing products at the best rates. If you have any questions about your credit score, speak to a qualified expert.

Hard credit searches

A hard credit search is when a lender checks your credit reports before approving you for a loan or credit card. This type of search will leave a footprint on your report, which could damage your score.

How to improve your credit score

There are a number of things you can do to improve your credit score, such as:

Checking your credit report for errors

If you find an error on your credit report, you can dispute it with the relevant organisation.

Making all of your payments on time

Paying all of your bills on time, including utility bills and rent, shows lenders that you are responsible with money. This can help to improve your score.

Keeping balances low on credit cards and loans

If you keep your balances low, it will show lenders that you are not over-extending yourself financially. This can help to improve your score.

Paying off debt

If you pay off any outstanding debts, it will show lenders that you are able to manage your money responsibly. This can help to improve your score.

Not applying for too much credit

Every time you apply for new credit, it leaves a footprint on your file. Too many footprints in a short space of time can be viewed negatively by lenders. So, if you need to apply for new credit, space out your applications so they are several months apart.

Diversifying your credit mix

Having a mix of different types of credit, such as a mortgage, or a car loan.

Register to vote

Registering to vote is important for your credit rating because it shows lenders that you are a resident at your address. This can help to improve your score by making you appear more stable.

Consider a credit-builder card

A credit-builder card is a type of credit card that can help you to improve your score. These cards usually have lower credit limits and higher interest rates than standard cards, but they can help you to improve your score by showing that you can manage your credit responsibly.

Keep an eye on your report

You should check your credit report regularly so you can see how your score is progressing. You can get a free copy of your report from each of the main credit reporting agencies once a year.

Check for errors

If you find an error on your credit report, you can dispute it with the relevant organisation. This could help to improve your score.

Get a copy of your credit reference file

You should get a copy of your credit reference file because it contains information that could be affecting your credit score. You can get usually a free copy of your file from each of the main credit reporting agencies once a year.

What information is kept by credit reference agencies?

The main credit reference agencies, usually have:

- Your name, address and date of birth

- Your credit history, including any applications for credit, credit limits and repayment history

- Details of any County Court Judgments or bankruptcies against you

- Any Electoral Roll information

- Any financial links you have with other people

- Information about your current account, such as whether you have ever gone overdrawn

What factors drop your credit score?

Your credit score can drop if you :

- Make late or missed payments

- Have CCJs or bankruptcies

- Have a lot of debt

- Have too many credit applications in a short space of time

Is 700 a good credit score?

A credit score of 700 is generally considered to be good. It may not be the highest possible score, but it should give you access to most types of credit.

What is a perfect credit score?

There is no such thing as a ‘perfect’ credit score because each lender has different criteria for what they consider to be acceptable. However, if you have a score of 850, this is generally considered to be excellent.

How long does it take to recover your credit score?

It can take several months to improve your credit score. However, if you make all of your payments on time and keep your balances low, you should see a gradual improvement over time. Improvements you will see include :

- Lower interest rates

- More favourable loan terms

- Higher credit limits

You can get a free copy of your credit report from each of the main credit reporting agencies once a year. You should check your report regularly to make sure that all of the information is accurate and up-to-date. If you find an error, you can dispute it with the relevant organisation. This could help to improve your score.

It is also a good idea to diversify your credit mix by having a mix of different types of credit, such as a mortgage, a car loan, and a credit card. This can show lenders, such as your mortgage lenders, that you are able to manage your money responsibly.

If you need to apply for new credit, space out your applications. Applying for too much credit in a short period of time can be a red flag for lenders and can negatively affect your score.

Finally, remember that it takes time to improve your credit score. If you are consistent with making all of your payments on time and keeping your balances low, you should see a gradual improvement over time.

How does identity theft impact your credit score?

If you’re the victim of identity theft, your credit score will suffer. Because thieves may use your personal information to apply for credit in your name. This can result in a significant debt and a poor credit history, which will have an impact on your score.

You should contact the relevant authorities as soon on as possible so they can assist you in protecting your credit rating if you believe you might be a victim of identity theft.

Would you like more information about your personal credit rating?

Checkmyfile can show you, in one report, data from the leading 3 agencies in the UK

Read some recent 5 star client testimonials, on Trustpilot, about Checkmyfile’s comprehensive credit report

Try free for 30 days and get the information that you need, then £14.99 per month. However, you can cancel online at any time. If you sign up, we will receive a small payment for introducing you. This helps us produce more content for the site.

Article author

Katy Davies

I am a keen reader and writer and have been helping to write and produce the legal content for the site since the launch. I studied for a law degree at Manchester University and I use that theoretical experience, as well as my practical experience as a solicitor, to help produce legal content which I hope you find helpful.

Outside of work, I love the snow and am a keen snowboarder. Most winters you will see me trying to get away for long weekends to the slopes in Switzerland or France.

Email – [email protected]

Frequently Asked Questions

How Credit Scores Work

A credit score is a number that represents your creditworthiness. Lenders use credit scores to help them assess whether you are a good borrower or not.

Your credit score is based on information in your credit report, which is a record of your credit activity.

What is a good credit score?

In the UK, there is no such thing as a ‘perfect’ credit score. However, if you have a score of 700 or above on your credit report, this is generally considered to be good. A score of 750 or above is usually considered to be excellent.

What factors drop your credit score?

Your credit score can drop if you :

Make late or missed payments

Have CCJs or bankruptcies

Have a lot of debt

Have too many credit applications in a short space of time

Is 700 a good credit score?

A credit score of 700 is generally considered to be good. It may not be the highest possible score, but it should give you access to most types of credit.