April 2024

Impact of a joint account on a credit rating in the UK in April 2024

In this article, we will look at what impact a joint account can have on each other’s credit rating.

What is a joint bank account?

A joint bank account is one that two or more people have full access to.

They can all deposit and withdraw money from it, much like a regular personal bank account. However, dividing up spending becomes difficult as both parties are legally responsible for the entire balance of the account.

This means that if there is not enough money in the account to cover withdrawal requests, any transactions are still valid – even though they may leave one party unable to pay rent.

Topics that you will find covered on this page

You can listen to an audio recording of this page below.

How does this affect my credit rating?

Essentially, having an overdrawn joint bank account will hurt your credit rating just as much as if you were able to personally guarantee said overdrafts.

Likewise, missed or late payments on your credit card will also appear on your credit report.

Your partner would be seen by lenders as an individual contact. If they struggle with making repayments, lenders will take this into consideration when assessing your own creditworthiness.

Lenders have a duty to undertake “reasonable enquiries” about you before offering a joint account credit line.

In general, they will look at the overall financial situation of both account holders and use an average of the two incomes – less any other outstanding loans – as a means of working out how much money there is available to service debt repayments. If one party has poor repayment history, it may be refused access to a joint account line in future.

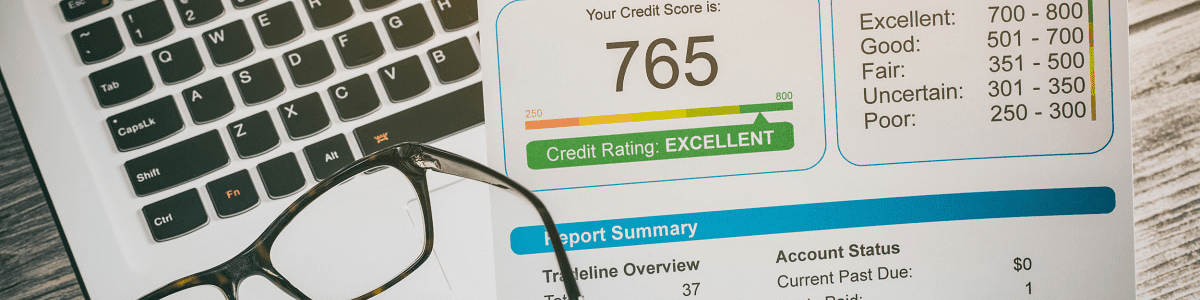

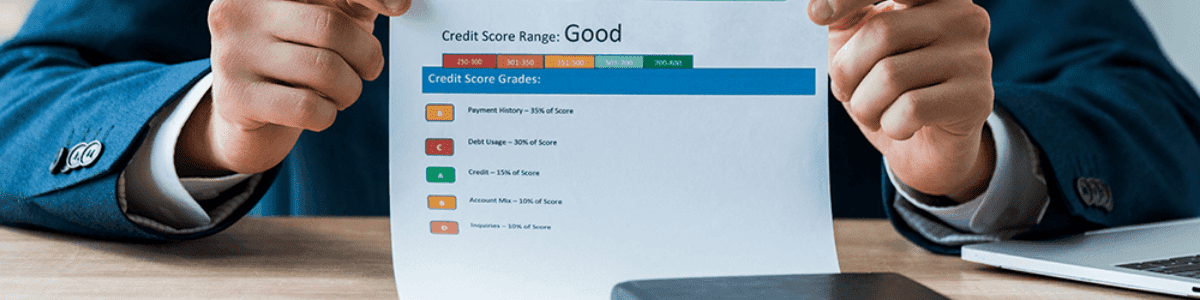

What is a credit rating?

A credit rating is a numerical value that lenders use to determine the level of risk associated with lending money.

Credit reference agencies do not hold any information about joint accounts, only an individual’s own personal and financial circumstances and history – although this will be averaged out with your partner’s.

Your overall credit score (known as a “credit profile”) is made up of two types of scores

– A “personal” credit score which shows how well you manage your finances; and

– A “new credit” score which shows how easily you can get new lines of credit such as bank loans or mortgages.

How Do Joint Finances Affect Your Credit Rating?

It is becoming increasingly common for lenders to ask all applicants for joint accounts whether or not they will be willing to accept responsibility for their partner’s existing debts. This may be in addition to receiving an offer on their own account.

Some couples choose not to disclose each other’s details when applying for loans and mortgages. Doing so, however, could lead to disagreements later down the line. If one person misses payments, it reflects badly on both of you – even if they are not your direct responsibility.

Lenders do also take into consideration the stability of relationships when assessing a partner’s credit profile.

If the other party is frequently changing their name, applying for new lines of credit or has recently been declared bankrupt, this will be seen as a sign that the relationship may not last and therefore they are considered a higher risk to lend money to.

Why do lenders ask if I am willing to take responsibility for my partner’s debts?

It is rare today for a lender to be able to assess your finances without taking into consideration those of your spouse or partners.

This allows them access to more information, which brings with it benefits such as being able to offer you larger amounts of money upfront, although the drawbacks can be negative too – such as having an increased exposure in case there are any payment defaults.

Would you like more information about your personal credit rating?

Checkmyfile can show you, in one report, data from the leading 3 agencies in the UK

Read some recent 5 star client testimonials, on Trustpilot, about Checkmyfile’s comprehensive credit report

Try free for 30 days and get the information that you need, then £14.99 per month. However, you can cancel online at any time. If you sign up, we will receive a small payment for introducing you. This helps us produce more content for the site.

How long is information kept by a credit reference agency?

A credit reference agency stores information about your credit history for up to six years.

For information, the main agencies in the UK are Experian, TransUnion and Equifax.

If you apply for a joint account at any time after you have previously defaulted on an application for credit, this will be seen as an increased risk – even if it is your partner who has caused the problem. This information comes out of the credit check that the agency undertakes on you and your spouse or partner.

Clean up your credit reference file

You can clean up your thin credit file by paying off existing debts or disputing any errors.

Ensure that the most accurate information is being reported about you by checking your reports regularly with credit reference agencies, certainly if there are large amounts of credit outstanding on one account, but possibly even more often than this.

The length of time that negative marks remain on your file varies depending on whether they relate to missed or late repayments. Typically, these will be removed after six years.

If you have never previously applied for credit, it may be worth waiting until you have done so before applying for new lines of credit (such as mortgages, car finance or personal loans) to make sure that there are no adverse marks against you which may lead to your application being declined.

You can also improve your credit rating by applying for a line of credit and making timely repayments on it. This will demonstrate to lenders that you are able to manage finances responsibly early on in an account, which could help you secure a better deal later down the line.

Finally, always pay your bills on time. A good way to do this is to set a direct debit so that you know that payments are always being paid on time. Be wary of inadvertently going into your overdraft though.

Even if you are in the process of applying for new credit, ensure that all outstanding balances are paid on time.

If you can’t afford to pay your debts when they fall due, either speak to your creditor (for instance, your bank) about changing the terms of your account or seek help from a free debt advice organisation.

"A credit rating is a numerical value that lenders use to determine the level of risk associated with lending money."

Help & Advice Tweet

Does marriage affect your credit score?

In the UK, marriage does not affect your credit score.

However, if you choose to change your name to that of your partner’s when getting married, this will be registered on your credit file and could have a positive impact on your rating.

What happens if I have a different credit rating from my partner?

If your and your partner’s credit scores are different, this could lead to you not being successful when applying for joint accounts.

Lenders may be willing to consider an account where one person has a lower score than the other but they will generally only do so if there is a very good reason how it helps the applicant manage their finances better overall.

In most cases, lenders feel that it would be better to have two people with strong credit profiles rather than just one – which means that even if the other party does not take their responsibilities seriously, there can still be financial consequences from missed payments.

How to manage if your spouse has a poor credit score?

If your spouse or partner has a poor credit score, but you have a good credit rating, you may still be able to get a joint account or a joint mortgage together.

While your credit profile will not have any bearing on the decision, lenders will take other factors into consideration such as your employment status and income levels.

Lenders will also look at any history of missed payments outside of the joint loan in question and whether these could be repeated in future – for example, if you have previous defaults but no missed payments against the account in question.

Should I mix my finances with my partner’s?

Before opening a joint account, you might want to consider how your partner manages their finances. If they are not good at managing money or have previously missed out on repayments, it may be better to keep your individual accounts separate.

It is up to you whether you chose to maintain separate accounts with different credit scores or combine them into one single account – the first option may be easier for you both but will have no impact on your respective credit profiles.

If there are other forms of income that you do not wish to disclose, then this can also impact how likely lenders are willing to approve an account.

Joint bank accounts – The pros and cons

The pros of having a joint account are that you can both manage your finances better, have access to more flexible accounts and benefit from lower fees.

The biggest con is if one partner does not make timely repayments or allows the account to fall into arrears, this will affect the other person’s credit rating.

If you do not trust your partner with money, it is important to consider whether having a joint account is right for you before applying.

If one party misuses the funds then the other may want to take action against them which could lead to conflict in future. You should also consider that while taking legal action may help restore your credit rating, it cannot change how lenders view past behaviour.

What creates a financial association?

A financial association is created by either getting married or entering into a civil partnership.

If you are in a financial association, lenders will consider both parties responsible for the joint account and payment history.

If you divorce your partner, this does not immediately stop your financial association with them – if they still owe money it may appear on your credit rating following the split but should automatically be removed within 6 years of ending the financial disassociation.

Joint accounts can also help improve your rating by increasing the number of active lines of credit on your report, which can demonstrate that you have more resources to borrow against.

If you get married, this will be registered on your credit file and could have a positive impact on your rating.

The same applies to civil partnerships or cohabiting partners who have been together for three years or more – if one person is bankrupt then the other can also be declared bankrupt.

When banks share information, any account that a borrower has should be included in their profile regardless of which name appears on it. If you are not comfortable being financially associated with your partner, then it may be better to keep them separate from one another.

Does sharing an address create a financial association?

No, having the same address does not automatically create a financial association

However, you can include your partner’s name on your account and then lenders will consider them responsible for the repayment history. You should note that this would be noted on both your credit files and could affect each of your scores in different ways.

If one person moves out but continues to pay bills from their old address, this would also count as an active account and could therefore improve or harm their rating depending on whether they make timely repayments or defaults.

It is worth noting that even if you do not share a joint account with someone, simply having them added to one of your accounts could still impact your score negatively if they fail to keep up with repayments.

Does a joint bank account create a financial association?

No, simply having a joint account does not create a financial association with another person.

However, lenders will consider that anyone on the same account or with access to it is responsible for repayment history.

If you are applying for credit, your lender might ask which bank you hold your account with. It is worth considering how this information could be used before giving out the name of the bank. For example, if one partner has an adverse credit history then their name appearing on an account could harm rather than improve your rating.

How to remove a financial association with your partner?

You can remove a financial association by cancelling the joint account and informing your lender that you no longer wish to be considered financially associated with them.

You can also ask your bank to remove any previous accounts if they are no longer active.

However, you should be aware that lenders are permitted to keep old information on file for up to six years and it could still count against your credit rating even if you decide to remove the association.

How long does a financial association last?

Usually, a financial association will only continue as long as both parties remain responsible for debts and active accounts. If all joint accounts and arrangements have been ended then this should reduce or remove any negative impacts on your score.

If either of you remains liable for debts, such as through an IVA or ongoing bankruptcy restrictions, then you may need to take further steps to avoid being financially associated with them in future.

Will changing your name impact your credit score?

Yes, changing your name on all of your accounts will have a negative impact on your credit score unless you can provide evidence that you are using the new spelling for professional reasons.

It is worth noting however that some lenders may still take the old version of your name into account even if it appears differently. For example, if you change your surname to one which contains an extra letter then this could be recorded incorrectly by some firms who had previously known you by a different name.

Would you like more information about your personal credit rating?

Checkmyfile can show you, in one report, data from the leading 3 agencies in the UK

Read some recent 5 star client testimonials, on Trustpilot, about Checkmyfile’s comprehensive credit report

Try free for 30 days and get the information that you need, then £14.99 per month. However, you can cancel online at any time. If you sign up, we will receive a small payment for introducing you. This helps us produce more content for the site.

Article author

James Lloyd

I am the primary writer and author for Help and Advice, having originally helped start the site because I recognised that there was a need for easy to read, free and comprehensive information on the web. I have been able to use my background in finance to produce a number of articles for the site, as well as develop the financial fitness assessment tool. This is a tool that provides you with practical advice on improving your personal financial health.

Outside of work I am a keen rugby player and used to play up to a semi-professional level before the years of injury finally took their toll. Now you are more likely to see me in the clubhouse enjoying the game.

Email – [email protected]

Linked in – Connect with me

Frequently Asked Questions

How does this affect my credit rating?

Essentially, having an overdrawn joint bank account will hurt your credit rating just as much as if you were able to personally guarantee said overdrafts.

What is a credit rating?

A credit rating is a numerical value that lenders use to determine the level of risk associated with lending money.

How Do Joint Finances Affect Your Credit Rating?

It is becoming increasingly common for lenders to ask all applicants for joint accounts whether or not they will be willing to accept responsibility for their partner’s existing debts. This may be in addition to receiving an offer on their own account.

Does marriage affect your credit score?

In the UK, marriage does not affect your credit score.

However, if you choose to change your name to that of your partner’s when getting married, this will be registered on your credit file and could have a positive impact on your rating.